Tax returns are in the news recently.

Political candidates for president (and many other offices) since Richard Nixon have made public their most recent tax returns. Hillary released the last eight years of hers in July, 2015 but her opponent (the one whose name shall not be mentioned, if you recall) has yet to release his.

Release them, release them, I hear the chorus chanting. You must be hiding something.

So, I got thinking. What if we all made our tax returns public? What would that mean? What would change?

Think about it a minute. If you released your tax return to the public (somehow; the logistics are TBD) we’d know how much total income you made last year, the sources of that income, the deductions you claimed, how much money you gave away, and how much you paid in taxes.

It’s possible I’ve missed a few; I don’t do our taxes here at home. But you get the idea.

How would you feel about that?

Embarrassed?

Exposed? Vulnerable?

Proud?

OK. Break’s over.

How much we make or own is considered no one else’s business; that, we tell ourselves, is private information. We place privacy on a high pedestal in this culture. We protect it in various Amendments to our Constitution. And, since our tax returns contain information we have traditionally considered no one else’s business — i.e, private — they are legally protected. Even presidential candidates are not required by law to release them.

Surprisingly (sort of), this is not a universally held value. The folks in Norway, for example, have been making their tax returns public since the early 1800s. They believe it results in more honesty about salaries, and discourages tax evasion. An article from The Guardian lays out their policy in more detail.

What is it about money that makes us want to hold our information so tightly to our chest?

Is this yet another behavior we cling to only because we’ve always done it that way?

I certainly don’t have the answers.

But I would love to know, for example, how our retirement pot compares to others’. Do we have enough? What is enough?

Back when I was working in corporate America (at U Penn; it was pretty corporate), if I had known the salaries of my cohorts at the other Schools, I might have gotten a raise. In any event, I’d have known whether I had a case for a raise.

This topic is of particular interest to me because over the past month or two I’ve shared a bit more about our own financial situation than is typically considered appropriate. First, how the foreclosure of our Chincoteague house killed our plans to pay for the many expenses we’d incurred here in Vermont, believing we’d pay for them “when the house sells.” The very same week we learned of Sasha’s injury and I wrote about that.

What I haven’t written about is that the week before all this hit us, I’d been writing our annual checks to various organizations I like to support, wishing I had more to give to support our local battered women’s shelter, our state’s Humanities and Arts programs, the environment, and the refuge problems that I’m finding overwhelmingly hard to even fathom. There is so much need in the world.

It was into this mind set that Sasha’s $4,500 surgery fell.

How much of that do I share? How much of our other financial obligations do I share?

What I was really struggling with in making this decision was how we spend money in this country, how we set priorities. And of one thing I’m certain, how we spend money is a reflection of our values; how we make choices is a reflection, one would hope, of the values we strive to live by.

In the blog post following Sasha’s announcement, The Evolution of PETS, I talked about how pets had grown into a $60 billion a year industry. I was not going to be a part of that!

I found it sad, in fact, that people do that. Judgmental? Perhaps. And $4,500 for knee surgery on a dog that had probably five more years of life, knowing there’d probably be a second surgery, just was too much to contemplate. Fortunately, I didn’t have to make a fast decision.

Next week, I’ll be back to fill you in on that final decision, how Sasha is doing, and why we made the decision we did.

In the meantime, how do you come down on sharing financial information?

Ian Mathie

I think anyone standing for public office must accept that everything in their lives is now open to legitimate public scrutiny and must be declared. They should be fully accountable, or at least open to examination.

Nobody is perfect and we all have scars, but if the public choose to accept the candidate in the full and open knowledge of their scars, so be it. That is their democratic right. To try and get elected whilst keeping secrets (apart from legitimate state secrets) is dishonest, deceitful and good reason not to trust the candidate. Indeed , such behaviour should disqualify that candidate.

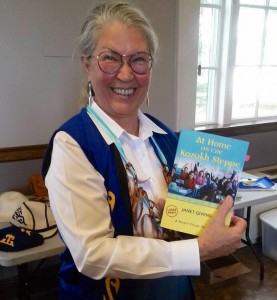

Janet Givens

But what about disclosing your return, Ian? If we all did, would it lead to a better society? I’m not advocating it (this is not like my DST posts), just curious how tenaciously we might cling to the privacy issue.

Val

I must have some Viking blood in me. I think it’s fair!

On the topic of revealing your taxes if you are running for President. I would say absolutely yes! It shows adherence and support of the law and the institutions that you would be leading. If you don’t honor what the government stands for, then you shouldn’t be running for President.

Unless it’s a coup of course ….. ?

Janet Givens

Thanks Val. It’s curious, I’m finding the longer I think about it, the less deplorable (I love using that word) it strikes me. What our political process must seem to you folks across the pond!!

Joan Z. Rough

Lots of big questions here. No answers forthcoming from here. It’s too complicated in an extremely overly complicated world.

Janet Givens

Yes, answers can be so overrated sometimes, It’s the questions that intrigue me. Always good to hear you weigh in, Joan. Thanks.

It’s the questions that intrigue me. Always good to hear you weigh in, Joan. Thanks.

Sharon Lippincott

My grandmother slept with her purse clutched in her arms like a teddy bear. Well, not really, but the metaphor describes her outlook on life. Nothing about her life was anybody’s business! Understanding the circumstances of her girlhood sheds a lot of light on this tendency of hers. My mother was the daughter of her mother, and not much in our family was anybody’s business either. Turns out that was mostly Mother. My dad talks about anything now.

Me, I’m my mother’s daughter, and my husband is much the same. I’ve grown to understand the roots of my privacy fixation and expand my boundaries by hundreds of percent. But still … circumspection has a lot to be said for it.

If our tax return were to become public, how would that change my life? Not in any major way I can think of. If I have way more than others, would that affect how they see me? If I have way less, would anyone be shocked? Basically, chosen lifestyle makes most people’s resources fairly apparent. For example, you can’t buy any house in Austin that costs less than a certain amount. You can’t enjoy frequent travel, especially in groups, especially overseas, without a certain level of financial means. Unless you have a fairy godmother. Would learning that my house purchase was subsidized make a difference to anyone? Probably … (Was it? None of your business, LOL!)

I can think of one good reason to do it. Getting a mortgage was an incredibly complicated affair. They constantly needed more forms. Or said they did. Which made no sense. If everything were a matter of public record, they’d already have access to it.

Another reason? When I worked for PNC corporation a couple of decades ago, disclosing your salary to another employee was grounds for dismissal. That led to exploitation, and (along with dozens of other factors) nurtured a culture of fear.

Transparency has a lot to be said for it. Thanks for the attitude exploration prompt.

Janet Givens

Thanks Sharon. Your comment reminded me of the relationship between what’s private and what’s secret, the secrets that are so often tied to shame. There are always boundaries. Borders. But where they are set up, how rigid they are, how porous, is such an individual matter. Your grandmother (and mother) sound all too familiar to me. How freeing it can be to know we choose our own path.

Merril Smith

I agree that politicians have to expect that their lives will scrutinized in great detail, and that includes tax returns. It seems pretty clear that DT does have lots to hide.

With Google and social media, so much can be found out about people anyway, I don’t know that disclosing tax returns is much different. (Aside from not publishing SS numbers and such.) Certainly if people are being paid on different scales for the same job, transparency could make the situation more equitable.

I think how people spend money and on what is something totally different. And putting a price on a loved one (human or animal), or being able to pay that price, is another topic, too.

Ian Mathie

If he has so much to hide, is he the right person to be President? I doubt it, because having so much to hide says he can’t be honest.

Merril Smith

For that and MANY, more reasons he should not be president. You didn’t think I was endorsing him, did you Ian? I think nearly every word he utters is a lie. He is a vile person–and I will stop there.

Ian Mathie

I certainly never dreamed you were endorsing anyone! I understood you were, quite rightly, opening up an issue of public concern fr intelligent discussion, something that appears to be in very short supply in the current election process.

Merril Smith

Samantha Bryant

Generally, I’m for transparency in all things. I doubt anyone would find a middle school teacher and novelist’s tax records interesting, but I wouldn’t have a problem with sharing information like that if everyone was. My worries would mostly be about being targeted by criminals and scam-artists if they thought I had something worth taking.

Janet

Hello Samantha. Thanks for joining in. It’s good to have you.

Christina Alexandra

It doesn’t matter to me if mybtaxvreturn is made public. As long as certain information isn’t revealed that could lead to identity theft, I’ve got nothing to hide.

I don’t make enough to be considered wealthy and I donate where I can. Like I keep telling people, I’m not that interesting!

Janet

Hello Christina. Great to have you join us. Thanks.

Tim Fearnside

Interesting. I could see some societal benefits to making tax returns public, particularly in terms of keeping people honest and transparency, etc. (not to mention, think of the research possibilities that would open up!), but it does make me personally squeamish. Some of the reasons have already been touched upon — i.e., concerns about theft, identity theft, targeting, etc. But for me, I think it’s more just plain, old-fashioned, midwestern, “mindyourownbeeswax” indoctrination. Simply put, I don’t want people (other than those I choose) to know what I make, don’t make, own, don’t own, win, lose, claim, deduct, itemize, or donate.

Possibly factoring into this, for me, also, is Americans’ sick obsession with personal wealth, and the tendency to judge, value, devalue, and form opinions about people based on how much they make and what they are “worth.” That term, alone, is rather offensive if you think about it — i.e., what a given person is “worth” — as if financial “worth” somehow equates to actual “worth.” I’d just assume people didn’t know, either way.

Janet Givens

Hi Tim, Thanks for weighing in. I wonder how the Norwegians get around the identity theft issue. The issue of our judging others based on their wealth is certainly an important one. The meaning we give to $xx in assets is somewhat unique to our culture, I’d guess. Makes me want to spend some time in Norway and see how they address that. I don’t think I’ve ever said I’d like to spend time in Norway.